Bookkeeping 101 - What Each Business Owner Must Know

Table of content

Overview

7 advantages of hiring a bookkeeper

Bookkeeping basics

DIY or Hire

Conclusion

Overview

What is bookkeeping, and why it truly matters

Bookkeeping is the process of recording and tracking company's financial transactions. It involves collecting and organizing data about your income, expenses, assets, liabilities, and equity over time. The purpose of bookkeeping is to provide clear records that can be used to generate reports for decision-making and tax compliance.

To know the health of your business, you must understand your financial reports. Keith Cunningham compares "reading financial statements to flying a plane: it takes a bit of learning, but you wouldn’t want to fly with a pilot who couldn’t read the dials.” 50% of small businesses do not survive 5 years. So investing in bookkeeping and getting familiar with your financial statements is key to your business's success.

7 advantages of a bookkeeper

Access to detailed records of all financial transactions

By keeping track of every financial transaction, you can easily access historical transactions and run reports. Maintaining your books provides peace of mind and the ability to rely on accurate reports. This is especially important in the event of an audit of your business's finances.

Improved financial reports = better decision making

The first step to making good financial decisions is understanding where the money is coming from and where it's going. A bookkeeper can help you accurately track all transactions and maintain clean business's financial records. This allows for better decision-making as you know what’s been spent, which assets are available, and when payments need to be made.

Reduced risk of fraud and theft

Bookkeepers are in charge of correctly documenting all financial transactions. This means that if there is any potential for fraud or theft, it can be detected and prevented either by implementing internal controls or regularly reviewing your financial reports.

Streamlining business processes

A bookkeeper helps streamline your business processes by providing accurate and organized financial records and by suggesting tools to automate data entry, collection, and reconciliation. This helps save time as all the information is organized in a way that makes it easy for you to locate and access and reduces

In addition, cloud-based bookkeepers can also provide suggestions to implement applications that help streamline operations and related accounting processes. For instance, techy bookkeeping companies help small business owners collect cash faster and reduce their accounts receivable by implementing electronic invoicing combined with e-payment, auto, or recurring payment options. This streamlines the accounts receivable process and improves cash collection. Who wouldn't want to get paid faster?

Save time and money on taxes

Bookkeepers can accurately track all financial transactions and make sure that each one is coded to the right account. Proper coding ensures that all tax deductions can be taken advantage of and that information is readily available at tax time. This helps to save both time and money when filing taxes.

Better access to funding opportunities

To obtain business loans or funds, lenders or investors often require accurate records of financial transactions. Bookkeepers can provide these records in a timely manner so that you can take advantage of funding opportunities.

Reduced stress and paperwork burden

Bookkeepers can take over the tedious task of documenting financial transactions from you, freeing up your time to focus on other aspects of running a business. This reduces both stress and paperwork, making it easier for you to manage your business.

Bookkeeping basics

Cash-based vs accrual-based

There are two ways to record financial transactions: on a cash or on an accrual basis. The decision depends on the way you recognize revenue and expenses.

On a cash basis, your net profit is the difference between "cash in" less "cash out". The expenses are recorded when the cash clears the bank account. Revenue is recorded when the cash is received in your bank account. Any money entering or exiting the bank account is recorded on the date it hits the bank account.

On an accrual basis, revenue is recognized when it’s earned, regardless of when the cash was received. So revenue is recognized on your income statement when you invoice your customer, not on the date you receive payment. Similarly, expenses are recorded when they’re incurred, not when the bill is due or paid. This method gives you a clear picture of your financial performance as it spreads out payments over time and ensures that income/expense transactions are accounted for in the right period.

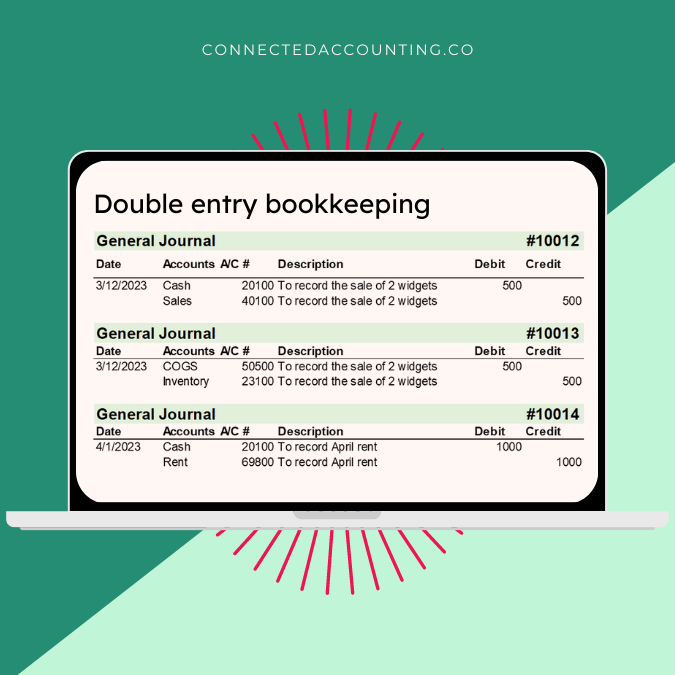

Single entry bookkeeping vs double entry bookkeeping

Very small businesses sometimes use a single entry system. Each financial transaction is typically recorded in a cash register on a cash basis. There is no requisite accounting training to use this entry system, but it's limited and does not allow for the preparation of balance sheet statements since it does not track asset accounts such as inventory, depreciation, accounts payable, and more.

The double entry bookkeeping system is the preferred method for most businesses. It can be done on a cash or accrual method. This system records transactions in two accounts, a debit and a credit account. For each transaction, one account will be debited and another credited. For instance, when you pay your cell phone bill, you debit an expense account (telephone expense) and credit an asset account (cash account). Every transaction must have equal credits and debits to prevent errors or omissions.

Overall, double entry bookkeeping is more accurate compared to single entry and provides more insight into how a business is performing.

Bookkeeping process 101

The accounting process involves several steps to ensure all transactions are recorded using the right accounting method.

Bookkeeping steps to producing financial statements

If you don't have financial records: the first step is to set up an accounting system and chart of accounts, preferably an online double entry system.

Then, on a daily, weekly, or monthly basis, bookkeeping entails:

Keeping records of all supporting documentation (bills, invoices, receipts), staying organized

Identifying the types of daily transactions: expense, income, asset, liability, or equity

Recording financial transactions in the accounting system

Recording journal entries

Reconciling your accounts, making sure no more transactions need recording

Reviewing your trial balance at the end of the month, verifying each debit and credit balances

Reviewing your general ledger to ensure transactions are correctly coded

Running your accounts payable and accounts receivable aging reports and taking corrective actions

Issuing financial statements (income statement, balance sheet, cash flow statement) and taking the time to digest the financial information

Sending a copy of your reports to your tax team for sales tax filing, tax returns preparation, or tax estimates calculation

Additional bookkeeping responsibilities can include processing bills for payment, issuing invoices to customers, collecting invoice payments, processing payroll, filing 1099s, assisting with workers' compensation audits, and more.

Most small business owners can handle a few bookkeeping basics on their own. However, it's not recommended, especially if the accounting is on an accrual basis. New business owners need to know that as their business grows or if they need external funding, they will need expert help.

DIY or Hire?

DIY: Should I do my own bookkeeping?

If you are a new business owner with limited resources, you may want to consider doing your own bookkeeping. Although it requires time and effort, it can be done if you have the right knowledge, skills, and systems in place.

Can I teach myself bookkeeping?

Yes, you can take online accounting classes and get certified with accounting software providers. But again, consider the cost of your time and the risks associated with errors or inaccurate financial data. You also need to know deadlines and filing requirements to stay compliant, such as sales tax filing, payroll taxes returns, etc.

When do I have to start outsourcing?

Consider hiring a bookkeeping specialist if you’re not sure about the accuracy of your financial data. Unless you have a degree in accounting or experience working as an accountant, you will need a bookkeeper's help pretty quickly. For example, you will need guidance and clear accounting processes when you start to sell products and have to handle invoicing, issuing credit memos, and processing sales tax filings; or when you hire employees or contractors and need to file payroll returns, issue W2s, and 1099s, etc.

Hiring a professional bookkeeper is a great way to ensure your books are accurate, timely, and compliant with tax regulations. They can also provide valuable insights into your business operations.

Hiring a Bookkeeper

When you want to leave the bookkeeping task to another person, there are two types of bookkeeping options to consider: in-house or an outsourced company.

In-house bookkeeping vs outsourced bookkeeping companies

You can hire a full-time or part-time individual bookkeeper to handle your bookkeeping. An individual bookkeeper is more expensive due to overhead costs such as salaries, benefits, office space, and training. In addition, if the bookkeeper leaves or becomes unavailable due to illness or vacation, it’s up to you to find someone else. However, with in-house bookkeeping, you have greater oversight and can sometimes have the bookkeeper help with non-accounting administrative tasks.

On the other end, outsourcing your bookkeeping will allow you to focus on important business activities such as growing your customer base and increasing sales. An experienced bookkeeper will be familiar with the latest accounting software, have expertise in accounting, and be able to advise you on business decisions and teach you how to interpret your financial statements.

In recent years, it's been difficult to hire bookkeepers and accountants as fewer students graduate in bookkeeping and accounting and as baby boomer bookkeepers retire en mass. So nowadays, it is sometimes easier to find an outsourced company than a single individual.

In-house bookkeeping requires a larger initial time and money investment. Outsourcing your bookkeeping to an outside provider offers more flexibility, scalability, and cost savings. When deciding which model is best for you, consider the size of your business, the complexity of your books, and how much support and guidance you need.

What questions to ask a bookkeeper when hiring them?

When making the decision to hire a bookkeeper, be sure to ask them questions about their qualifications, experience, and references. You may also want to inquire about how they charge for their services. You must be comfortable with their services before signing any contracts. Also, remember to confirm the timing of deliverables and when you can expect bills to be paid, invoices to be processed, and financial documents to be issued.

Here is are 5 questions to ask a bookkeeper for hire:

What are your qualifications?

Bookkeepers should have a strong understanding of accounting principles and financial reporting requirements. They should be able to provide valuable insights that can help you make informed decisions about the financial health of your business. Experienced bookkeepers or accountants (higher level) should be experienced in problem-solving and adept at handling difficult numbers, and have basic taxation knowledge. Some controller level accountants can be public accountants as well (CPA) and have to take continuing education courses.

At the minimum, ensure your bookkeeper has a bachelor's degree in accounting and is certified on the applications they use (i.e. QuickBooks or Xero Certified).

How do you keep up with technology?

Bookkeepers should stay up to date on changes in the industry and be aware of new technology. They should understand the different types of accounting software available, what applications can streamline processes, and automate data entry to reduce errors and help ensure accuracy in financial reports.

Who will I be working with on your team? How do I reach out to them? How fast will they respond?

This can vary from one company to another. If you hire a smaller bookkeeping firm, you might only have one person on your account. Whereas a mid-size firm could have up to three people on your account (an accounts payable clerk, a bookkeeper, and a controller-level accountant).

Understanding communication styles and frequency is very important. Do you have unlimited access to your point person (calls, texts, emails)? Is communication only available through messaging or a portal? Do you get recurring video meetings? How fast do they respond to emails?

What are the dates of my deliverables? When do you issue invoices to my customers? How often do you pay my bills? When do I receive my financial statements?

Again, ensure you understand what is expected of you (i.e. providing all paper check pictures by the last day of the month), so the outsourced company can provide reports timely. Ask how they keep track of deadlines and what happens if they miss them.

What is your experience working with companies in my industry?

Bookkeepers should also have the necessary qualifications to ensure they are up to date with industry standards. Different industries require different financial statements preparation.

What does a bookkeeper charge?

The cost of bookkeeping services is determined by the size of your business (volume of transactions), complexity of your books (tracking by projects, intercompany transactions, sales process, etc.), and type of accounting (cash or accrual). Those factors determine what services you need (recording financial transactions, payroll processing, bill pay management, invoicing your customer, etc.) and the related-skills required to service your account (payroll processing and sales tax remittance are more technical than data entry).

The bookkeeper may charge a flat monthly or annual rate based on purchased services. Some professionals still bill clients hourly and offer discounts for a bulk purchase of hours which can be beneficial if you know the exact tasks that need to be completed. Other bookkeepers prefer to use different billing methods, such as retainer fees or project-based payments.

Conclusion

Before you hire a bookkeeper to help manage your business finances, it’s important to make sure they have the necessary qualifications and experience. Ask questions about their technology proficiency, data security practices, and billing structure to ensure you are getting the best fit for your business. Additionally, discuss how they will help you streamline processes and improve efficiency. The right bookkeeper can make a huge difference in the success of your business. With their help, you will be able to focus on growing your business, knowing your finances are handled by an experienced professional.

Ready to get started?

At Connected Accounting, we make accounting easy.

Get time back in your day with automated solutions and the support of our reliable team-feel at ease making data-backed business decisions.